The first thing that really blew me away was this article linked to by the Oil Drum, on the impact of new technologies on resource extraction. It confirms a lot of what has been reported from the North Sea and the Persian Gulf - the new technologies that are supposed to save us might actually be doing the opposite. From the paper's abstract:

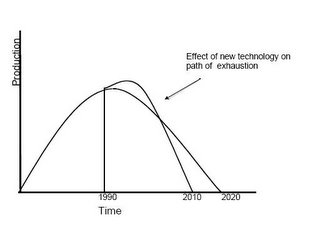

In this paper we use results from the Hotelling model of non-renewable resources to examine the hypothesis that technology may increase petroleum reserves. We present empirical evidence from two well-documented mega-oilfields: the Forties in the North Sea and the Yates in West Texas. Patterns of depletion in these two fields suggest that when a resource is finite, technological improvements do increase supply temporarily. But in these two fields, the effect of new technology was to increase the rate of depletion without altering the fields ultimate recovery - in line with Hotellings predictions. Our results imply that temporary low prices may be misleading indicators of future resource scarcity and call into question the future ability of current mega-oilfields to meet a sharp increase in oil demand.So we're doubly screwed. First of all, the new technologies don't actually increase the amount of oil available, they just increase the rate at which we can get at that oil. Net result: the oil runs out sooner. Secondly, because it allows greater volume of production, the price of the oil in question drops - leading to greater consumption and a belief that supplies are assured. Of course, the supplies aren't assured, they're even more imperiled than before. A handy graph, from the paper:

So we get a temporary bump in production, which depresses prices and hastens the demise of the field. Not a particularly helpful advance, all things considered.

Ah, but if we find more oil, we're okay, right? Not so much. First item: A graph of oil discoveries over the last 70 years and predicting the next 50:

Notice the downward trend beginning in the 1960s. Discoveries, judging by this graph, peaked in 1965 and have never again reached those levels. But let's go back to prices for a moment: What's happened since 1965? Well, two wars against Israel, the 1973 oil embargo, the 1979 oil shock, the first and second Iraq wars - just to begin with. In at least three cases we saw major price spikes (1973, 1979, 1991) and the 1970s in general saw a period of sustained high prices. And yes, we saw a period of increased discoveries - but nowhere near the 1965 peak. Another peak about the time of the first Gulf War (though the initial price increase preceded the war) only peaked about 1/3 of the 1965 rate of discovery. Last year, we discovered about 7 billion barrels of oil. We used more than 30 billion.

I think we can say, based on past trends, that there is no cornucopia out there waiting to be found. Not again, anyway.

Okay, but what about alternatives? The tar sands are inevitably trotted out here. I laughed when I read this today, via greencarcongress.

Fort McMurray, Alberta (January 5, 2006) – Suncor Energy Inc. yesterday reached a significant milestone at its oil sands facility – the sale of its billionth barrel of oil sands crude since operations began in 1967.So, it's taken more than 30 years to produce 1 billion barrels of oil at Suncor. At that rate, we'd produce one year's worth of oil... by the year 3000? Actually, the press release says that half of that production is since 1996, so it's only taken them 10 years to produce a half billion barrels. Still, we'd need 600 Suncor-years worth of production to meet current demand. The tar sands are not, as I've said over and over, going to save us.

Still, I don't ignore the potential for efficiency, renewables, etc. But here's the problem - the one sustained period of declining oil consumption we have on record (roughly 1978-83) led to a decline in oil use of about 20% over 5 years - a good job, no doubt about it. (You can check my figures here.) But what scares the everloving crap out of me is the possibility that oil might decline even faster. Go back to what we saw above - new extraction technologies don't increase the available oil, they just hasten the decline. The North Sea, Texas, and some Gulf states are seeing 10%+ decline rates every year. Norway declined 12% this year alone. Worldwide figures probably won't be so scary, but that's cold comfort - if supply declines by 6% and we can only save 5% a year, we're still in quite a pickle.

I welcome a correction on any of this data or on the concepts. But I'm still waiting for the bright light here.

No comments:

Post a Comment