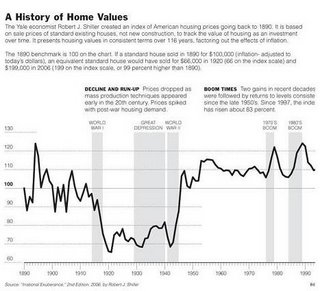

Hmm... not so bad... in the mid-1990s prices really came right back to their post-WWII average. I'm sure nothing changed since then, right?

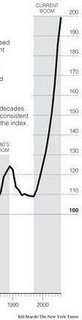

Oh, I forgot something:

Now, I vaguely remember the nasty headlines from the end of the 1980s real estate bubble. Of course, given the economic mess of the early 1990s, it was really just more noise. But I don't believe anyone has identified a single factor that would explain why home prices should not, eventually, return to their post-WWII average as they did before.

This has the potential to be very, very nasty.

2 comments:

Oddly enough, I'm going to write something about this today.

But remember, you're looking at U.S. data. Canadian house values have been increasing at under ten per cent per year over the past decade (with the possible exception of Calgary). That's not bubble territory. The issue is, does the collapse of the U.S. bubble send ripples through the Canadian general economy.

Probably it does.

The issue is, does the collapse of the U.S. bubble send ripples through the Canadian general economy.

Yes. To start with the US residential construction industry will go into a tailspin. This will likely cause the price of lumber to fall triggering the nasty tariffs that were written into Harper's softwood sellout (providing it passes through Parliament) if the price of lumber falls below a certain level.

Post a Comment