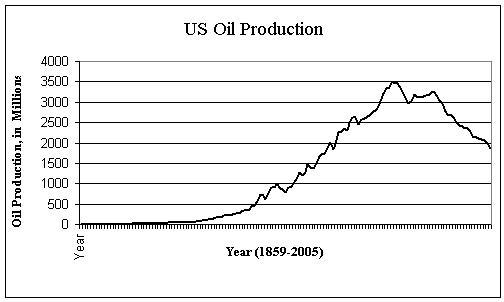

So this here is my lovingly-crafted graph of US oil production, 1859-2005. You'll note that the US hit it's peak production of just about 3.5 billion barrels annually in 1970. Since then, it's all been downhill. In fact, in 2004 America produced less than 2 billion barrels for the first time since 1950. Last years's production was the lowest since 1947. US Proven Reserves meanwhile are at the lowest point since 1946.

Nothing really newsworthy, especially, just chronicling the ongoing decline of the US oil industry.

However, I'd like to address something that maybe I haven't pointed out before, or emphasized enough. In response to PhillTaj in comments:

I actually just saw a documentary mid east oil- apparentely large swathes of the region is yet to be prospected for oil reserves- calm down buddy, its ok.This is the usual reasurring tone the oil industry presents, and Phil (may I call you Phil) isn't wrong - there are large parts of the world that are relatively unexplored by the oil industry. The problem is that there's no evidence that the oil industry will ever touch those places.

For a variety of reasons, we can expect future oil exploration - whatever actually occurs, which probably won't be much - to find even more dry holes than usual, with almost no chance of finding several supergiant fields in the future. The simplest reason is that Oil has been ridiculously profitable for quite a long time, giving everyone ample time to find the biggest sources of oil in the world. This is why the Persian Gulf states have largely been producing oil since the 1930s and 40s. If there were other giant fields hiding out there in the desert, we'd have found them now.

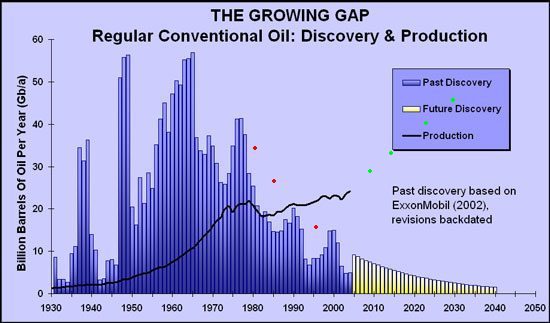

One of M. King Hubbert's under-appreciated realizations when he formulated his peak production theories was a simple fact: To produce oil, you need to find it first. He realized that since oil discoveries in the US had risen, peaked in the 1940s, and fallen, it was likely that oil production would face a similar fate.

Well global oil discoveries peaked during the Johnson Administration, and have been down ever since. This picture shows this perfectly:

There's a wall we hit with oil exploration, where you eventually spend more money finding oil than the oil itself is worth. There's two reasons for this. One, as the above graph shows, oil finds keep getting smaller and smaller. Two, the expense of finding even those tiny fields keeps going higher and higher. I haven't seen data to back this up, but I wouldn't be surprised if oil exploration is literally unprofitable at this point.

As goes exploration, so goes production. Hubbert's Law.

No comments:

Post a Comment