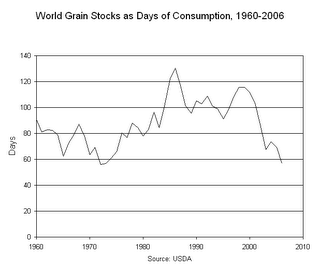

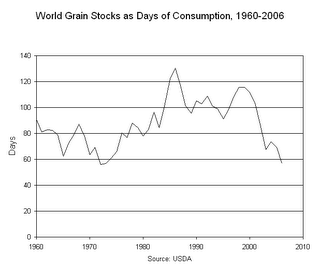

This, dear readers, is courtesy of the

WorldWatch Institute. It charts global food stocks in terms of days of remaining reserves. As you can see, global grain reserves are at their lowest point since Richard Nixon was president. According to Worldwatch:

This year’s world grain harvest is projected to fall short of consumption by 61 million tons, marking the sixth time in the last seven years that production has failed to satisfy demand. As a result of these shortfalls, world carryover stocks at the end of this crop year are projected to drop to 57 days of consumption, the shortest buffer since the 56-day-low in 1972 that triggered a doubling of grain prices.

World carryover stocks of grain, the amount in the bin when the next harvest begins, are the most basic measure of food security. Whenever stocks drop below 60 days of consumption, prices begin to rise. It thus came as no surprise when the U.S. Department of Agriculture (USDA) projected in its June 9 world crop report that this year’s wheat prices will be up by 14 percent and corn prices up by 22 percent over last year’s.

So now we've got oil and food prices as drivers of inflation. Great. Interestingly, these probably won't show up immediately in the headlines, given the convention of central banks to only focus on core inflation - that is, excluding food and energy prices.

This, dear readers, is courtesy of the WorldWatch Institute. It charts global food stocks in terms of days of remaining reserves. As you can see, global grain reserves are at their lowest point since Richard Nixon was president. According to Worldwatch:

This, dear readers, is courtesy of the WorldWatch Institute. It charts global food stocks in terms of days of remaining reserves. As you can see, global grain reserves are at their lowest point since Richard Nixon was president. According to Worldwatch:

2 comments:

All the more reason to go vegetarian. That's where the grain reserves are going, aren't they?.

People in the first world are unlikely to even notice an increase in grain prices. Currently wheat is only about 5% of the cost of a typical loaf of bread in the U.S. and grain prices are only forcast to increase slightly. This means that all other things being equal, higher grain prices should add less than one percent to the average American's food bill.

Post a Comment